Jason Lee, CEO and Founder of Salt Labs and Founder of DailyPay, talked about opportunities in fintech disruption during his presentation at the Afrotech Conference in Austin.

He shared how to spot some of the opportunities for anyone considering building or working in this space.

In 2015, Jason founded DailyPay in his basement to address a longstanding issue: the struggle of workers to cover expenses before payday. He introduced the Pay Balance, a real-time, fully funded ledger reflecting earned income throughout a pay period. After seven years, DailyPay serves 5 million American workers, allowing them to access earnings at their convenience. Valued at $2 billion and ranked among the top 30 apps, Jason exited in 2022. His new venture, Salt Labs, focuses on empowering workers by developing technology that facilitates ownership.

Fintech stands out as the most thrilling tech domain today, with over $128 trillion in annual payment volume in the US alone. The immense opportunity lies in disrupting a financial system dominated by rigid legacy systems, extensive regulation, bureaucracy, complacency, and a lack of true competitive spirit, making it ripe for innovative entrepreneurs.

Photo Credit: Jason Lee

Examining a prime example of disruptive innovation, the conventional consumer banking model, prevalent for decades, prioritized acquiring depositors and selling services like checking accounts and loans. However, around a decade ago, digital banks emerged as disruptors, emphasizing the creation of outstanding, fee-light products. Chime, a notable disruptor, garnered millions of users by offering features such as early payday and No Fee overdraft. By revolutionizing the accounting process, digital banks like Chime achieved remarkable Net Promoter Scores, rivaling consumer giants like Apple or Chick-fil-A. This disruption prompted traditional banks to elevate their offerings, benefiting consumers with improved products across the board.

Let’s take a look at how credit card purchases in the store work in the chart below.

Photo Credit: Jason Lee

This intricate process illustrates the complexities of enabling a simple store purchase, emphasizing the vast opportunities for improvement and disruption in financial technology. Consider the scenario at Starbucks: from the point of sale system, credit card verification through payment processors to card networks, each step offers numerous disruption possibilities. Innovations like Toast and Square enhance payment processes, while blockchain and digital currencies aim to revolutionize the entire payment flow. Financial technology extends beyond supporting financial service firms; companies like Shopify, Airbnb, Uber, and Etsy leverage fintech to dominate markets and generate substantial revenue, attracting significant outside investments in the thriving fintech sector.

Photo Credit: Jason Lee

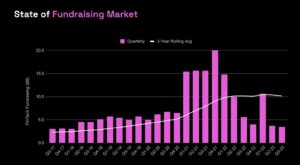

On the chart, you can observe a significant influx of venture capital in FinTech, despite some pullback in the last two years. The white line represents a three-year moving average, showing an upward trend. In 2021, one in every $5 of venture capital was invested in FinTech. Early-stage capital, known as precede or seed, remains active and receptive to new ideas. Financial innovation will persist as the world constantly requires money for growth. Money is essential for a healthy society, serving as a medium of exchange and a trusted form of payment. This ongoing innovation will continue to attract external investors.

Listening to the needs of consumers is what will continue driving innovation.

DailyPay was set out to destroy and eliminate the entire payday lending industry. It all started with understanding why consumers kept on using these products. This took hundreds of hours of research inside payday lending shops, talking to customers, meeting them in parking lots, understanding their pain, and ultimately building the solution for them.

Skipping this step and going straight to building your product will bring the odds of success to virtually zero.

Building a company is extremely hard, but the journey is undeniably rewarding. Solving real problems for consumers and enhancing their daily lives through innovative solutions not only transforms businesses but contributes to societal progress. The fintech landscape, ripe with opportunities, welcomes disruptors and innovators willing to challenge legacy systems. Jason’s success story underscores the immense potential for positive change, demonstrating that hard work pays off in creating meaningful advancements within the financial technology sector. As we embrace disruptors, we not only foster competition but collectively elevate the industry, benefiting consumers and driving continuous financial innovation.

Published by: Nelly Chavez